Question 1: Download the paper “Capital Structure Decisions: Which Factors Are Reliably

Important?” by Murray Z. Frank and Vidhan K. Goyal,. You are going to be asked to comment

on the abstract, the introduction and section 1. You can base your answer on the other content of

the paper (I would limit your reading to the introduction plus section 1, but you are more than

welcome to read the full paper).

https://onlinelibrary-wiley-com.tilburguniversity.idm.oclc.org/doi/full/10.1111/j.1755-

053X.2009.01026.x

a) In this paper, a list of “core factors” are listed that explain why firms have more or less

leverage. We ask you to comment on the 5 factors listed below with their expected sign:

The paper mentions theoretical signs (plus or minus) that should link the aforementioned factors

to firm leverage according to theory. For each of these factors, explain the rational for the

expected sign. In your answers, make sure to support your arguments using the theories we have

discussed in class (for instance trade-off theory of capital structure, pecking order theory)

Answer A) Requirement

When the indirect cost of having financial challenges is high, it is in the best interest of a company to avoid suffering such issues. Because of this, it is in the corporation’s best interest to maintain its leverage ratio as low as is reasonably practicable. This is as a consequence of the fact that having financial troubles may result in a considerable amount of extra indirect costs. If you are experiencing losses, you want to make sure that your leverage ratio is as low as it can possibly be since a higher leverage ratio would result in losses that are proportionately larger if they were already large. This objective will be easier to accomplish if your leverage ratio is as low as is practically possible. Maintaining a leverage ratio that is lower than what is technically possible is something you want to strive for if it is the case that yours is. You should make it a priority to maintain a leverage ratio that is as low as is reasonably practicable. This is as a result of the fact that having a higher leverage ratio necessitates having a greater quantity of debt, which is the primary factor that contributes to this specific consequence.

b) In section 1 of the paper, the concept of market timing is introduced. Explain what market

timing is and how it contrasts the pecking order theory and trade-off theory of capital structure.

Answer B) Requirement

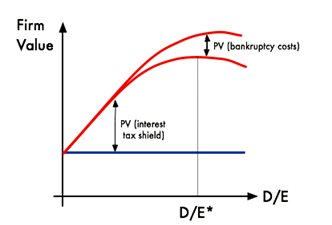

The concept of trade-off analyses the costs that are associated with filing for bankruptcy and arrives at the conclusion that debt financing offers a number of advantages over other types of financial assistance. This is done by comparing the costs of filing for bankruptcy with the costs of other types of financial assistance. According to the idea of a pecking order, personal donations from donors are seen as a more important source of financial assistance for an organisation than monetary contributions from the government. This is due to the fact that private fundraising enables a more direct engagement with the audience that is being sought. When it comes to concerns about the finances of a firm, the concept of striking a balance between conflicting goals has, for a very long time, served as the gold standard for selecting how to proceed in circumstances of this nature.

Question 2:

Answer) One possible cause of IPO underpricing is the winner’s curse hypothesis. Overpricing an initial public offering (IPO) makes it more probable that uneducated investors would acquire a bigger allotment than knowledgeable ones.

a) Underpricing is a key puzzle surrounding initial public offerings (IPOs). One possible

explanation for underpricing is to compensate for the “winner’s curse” in IPOs. Explain how

the winner’s curse leads to underpricing.

Answer A) Robinson

From what we’ve been told, the IPO will consist of 50,000,000 share offerings.

Price per share is $15

For his services, the underwriter will get a commission equal to seven percent of the total proceeds of the issuance.

b) Robinson Corp. has just completed an IPO, where 50 million shares were issued. The new

number of outstanding shares is 125 million shares. The IPO offering price of $22 per share.

On the offering date, the stock price increased to $40 per share by the end of the trading day.

Who gains from this increase in the price? Who loses, and how much?

Answer B) IPO proceeds = $50 million * $15 = $750 million Equity funds to business = IPO proceeds – underwriter fees

c) Now read the paper “Why Don’t Issuers Get Upset About Leaving Money on the Table in

IPOs?” by Loughran and Ritter.

https://academic.oup.com/rfs/article/15/2/413/1588150?login=true

Answer the following questions keeping in mind that you must explain the concepts clearly

using your own words.

How is the term “the money left on the table” is defined in the paper? Specify how do authors

explain “why issuers do not get upset about leaving money on the table”.

Answer C) Current Mathematical Formula

Fees paid to underwriters amount to $52.5 million (7 percent of $750 million).

By plugging numbers into the formula, we get

Money Raised by the Company from Investors = $750 Million – $52.5 Million

Whenever a big supplier is lost, a firm puts itself at risk of suffering a decline in profitability, which increases the likelihood that the company may go bankrupt. This is as a result of the fact that this places the company in a position in which it is forced to incur larger expenditures in order to meet the ever-increasing demands of its customers. The reason for this is due to the fact that this places the company in a position in which it is forced to meet. When something like this takes place, the corporation finds itself in a position where it might see a decrease in profitability. As a direct result of this, there is a risk that the profitability of the firm may decrease as a direct consequence of this. As a direct result of the turn of events that has taken place as a direct result of this turn of events, the degree to which the organization’s capital structure is sensitive to risk will be more exposed. This turn of events has taken place as a direct result of this turn of events.

The money left on the table is therefore be computed as 52.5 million

Question 3: Consider a setting with multiple deviations from perfect capital markets. In

particular:

- There are taxes on the corporate profits, at a rate of 45%

- There are personal taxes on interest income, at a rate of 30%

- Personal taxes on equity (capital gains or dividends) are 25%.

- Costs of financial distress exists. The present value of these expected costs, C(D),

are an increasing convex function of the debt in the firm, D:

Where D is measured in $Millions (and hence the costs of distress are also expressed in

$Million). Assume that the interest payments on the corporation are tax deductible (with no

limit). Also assume the corporations have very large EBIT, so the tax benefits of debt increase

(potentially indefinitely) for higher levels of debt.

a) Which inequality has to hold in order to have a marginal tax advantage of debt without the

presence of financial distress costs? Give an interpretation of this inequality.

Answer A) Requirement

Company Levered Value = Unlevered Value + Debt * Tax Rate = $80,000,000 + ($40,000,000 * 39%) = $80,000,000 + $15,600,000 = $95,000,000 The total debt plus the equity value of the firm comes to $ 95.60 million.

b) Compute the optimal value of perpetual debt D* in the capital structure of the firm, that

maximizes firm value. Show your work numerically and graphically (in a graph where debt D

is on the x axis and the value of the firm is on the y axis). Note: In the graph, please assume

that the unlevered firm value is $1million for simplicity.

Answer B) Requirement

| B | C | D | E | F | G | H |

| 091216Q24 | ||||||

| Assets | $450 | |||||

| Liabilities (Debt) (D) | $210 | |||||

| Equity (E) | $240 | |||||

| EBIT | $27 | |||||

| No. of shares outstanding | 30 | |||||

| Return on market portfolio | ||||||

| Interest rate on debt | 3% | |||||

| a) | EBIT | 30 | ||||

| Interest expense | $6.30 | |||||

| Net Income | $23.70 | |||||

| Equity | $240 | |||||

| Return on equity | 9.88% | |||||

| b) | D/(D+E) | 47% | ||||

| E/(D+E) | 53% | |||||

| WACC = (D/(D+E))*Rd + (E/(D+E))*Re | 6.67% | |||||

| c) | Dividend paid = Net income | $23.70 | ||||

| Cost of equity | 9.88% | |||||

| Value of the perpetuity | $240.00 | |||||

| Current Stock Price of the firm | $8.00 | |||||

| d) | New Balance sheet | |||||

| Assets | $450 | Equity | $450 | |||

| Since there is no debt now, | ||||||

| Net income = EBIT | $27 | |||||

| Dividend = Net Income | $27 | |||||

| Value of the firm | $273.42 | |||||

| New share price | $9.11 | |||||

c) In parts 1 and 2 of this question, we have implicitly maintained the assumption that the

investment plan of the firm stays the same and is independent of the capital structure.

However, when we introduce problems of asymmetric information and principal-agent

problems, the investment plans of a firm can change, leading to changes in the value of the

firm. Provide three examples of investment distortions that can occur in a firm when we

introduce the aforementioned problems. Clearly state whether these distortions are common

when there is too little leverage, or when there is too much leverage.

Note: Answer this question in general terms, and do not refer necessarily to the specific

aspects of the two previous parts of the problem.

Answer C) Requirement

The Principal Agent Framework might also be helpful in acquiring an understanding of the actions made by governmental agencies, which is another area of potential use for the framework. It is possible that managers may be enticed to grow their company beyond what is generally thought of as being the organization’s optimal size because of their desire for power and privileges. We have no means of knowing whether or not the work that public managers generate will be beneficial since it is so expensive to monitor the behaviour of public managers.

Question 4: Go to https://www.government.nl/topics/taxation-and-businesses/corporation-tax.

Search for corporate income tax and answer the following questions. Consider a private Dutch

firm which will have earnings before interests and taxes € 500,000 with no risk in year 2022. The

risk-free interest rate is 5%. Note: assume that the firm is not involved in any innovative

activities and assume interest payments are always deductible.

a) Assume the firm is unlevered. Based on the amount of taxable income in 2022 stated above,

the firm may subject to two different tax brackets for corporate income tax. What are the two

tax brackets?

Note: if you are unfamiliar with the notion of tax brackets, you can for instance refer to this

short video: https://www.youtube.com/watch?v=VJhsjUPDulw

Answer A) Requirement

Present value of Perpetual TAx Shield = Tax Shiled per annum/Required rate of return

3,00,000 = Debt Outstanding*10%*35%/0.10

3,00,000 = Debt Outstanding * 0.1*0.35/0.1

3,00,000 = Debt Outstanding *0.35

Debt Outstanding = 857,143

Now suppose the firm instead has a lower perpetual outstanding debt of € 2,000,000. What is the corporate income tax it must pay in year 2022?

2,00,000 = Debt Outstanding*10%*35%/0.10

2,00,000 = Debt Outstanding * 0.1*0.35/0.1

2,00,000 = Debt Outstanding *0.35

Debt Outstanding = 86340

b) Suppose now that the firm has perpetual outstanding debt of € 3,000,000. What is the

corporate income tax it must pay in year 2022?

Answer B) Requirement

A corporation with $300 million in net profits annually pays out $100 million in dividends. This results in a dividend payout ratio of 33% ($100,000,000 / $300,000,000). The dividend payout represents 33% of the company’s net income. In the meanwhile, its retention ratio is 66%, or 1 minus the dividend payout ratio (33%). This means that 66% of the company’s net income is kept in-house and used for growth.

Total = 52.5

c) Now suppose the firm instead has a lower perpetual outstanding debt of € 2,000,000. What is

the corporate income tax it must pay in year 2022?

Answer C) Requirement

A company’s debt-to-equity ratio is the sum of its debt divided by its shareholders’ equity. There should be no more than 1.5 times as much equity as debt.

Total 60.54

d) Suppose the firm distributes all of its net income to equity holders as dividends. What is the

dividend value when the outstanding debt is € 3,000,000? What is the dividend value when

the outstanding debt is € 2,000,000?

Answer D) Requirement

,00,000 = Debt Outstanding*10%*35%/0.10

3,00,000 = Debt Outstanding * 0.1*0.35/0.1

3,00,000 = Debt Outstanding *0.35

Debt Outstanding = 857,143

The answer is computed as 297500

Please place the order on the website to get your own firstly done finance homework help result.

Related Samples