Executive Summary

Understanding ratios is essential to understanding the core traits of every organization. Financial ratios can be used to evaluate any organization’s prosperity, from immediate success to long-term stability. By examining through different ratios over five year period, it is found that both COH and RMD has performed good during this period. But overall as for shareholders wealth is concerned or return on equity, COH has performed better than RMD. RMD outperformed COH throughout this time period in terms of average net profit margin, demonstrating that RMD produced greater profit for shareholders. Since RMD uses debt financing rather than equity financing and has more outstanding shares than COH, its return on equity is lower than COH’s. The management of the firm has managed its resources to create income successfully because the average assets turnover for the RMD is lower than that of the COH.

1.Introduction

Ratios are a crucial component in comprehending the fundamental characteristics of every organization. By using monetary ratios, it is possible to assess any organization’s prosperity from short-term success to long-term stability. They serve as the transcendent tools used in assessment. For examiners who rely on fiscal summaries to evaluate any element’s financial position at a certain time, monetary proportions are the crucial certainty (Gibson 1987). Even while financial ratios are crucial factors to consider when determining an organization’s key presentation, investors should also be concerned about other areas.

1.1 Cochlear Limited Company

Among its products are the Nucleus cochlear implant, the Hybrid electro-acoustic implant, and the Baha bone conduction implant. Cochlear is a manufacturer of medical devices. It was founded in 1981 and its headquarter is in Sydney. The main products of the company are followed

- Cochlear implants

- Bone-anchored hearing aids

- Cochlear wireless accessories

- Bone anchored prosthetics

More than 4000 people globally are employed by the company and contributing to its growth. The corporation operates in about 20 different nations throughout the world. By the end of 2021, 1497 million dollars had been earned overall. At the end of 2021, the corporation had a net income of 326.5 million dollars. Assets were valued a total of $2, 438, millions dollars.

2.Comparative ratio analyses

Periodic performance evaluation is crucial to ensuring alignment between the planned aim and the organization’s actual results. It may be both short- and long-term. Businesses have unique objectives in terms of establishment and success. In order to measure profitability, growth, and market share relative to competitors, a profit-seeking organization’s overarching strategic objective is to maximize shareholders’ wealth.

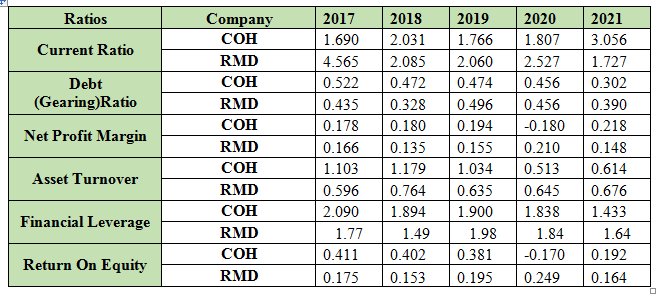

Table # 1 Ratio Analysis

2.1 Liquidity Ratio Comparison

In the above graph the liquidity of both COH and RMD is given. RMD has almost higher liquidity during this period expect 2021. At the end of 2021 the short term payment ability of COH is higher than the RMD. As for RMD is concerned it has highest liquidity for short term payments at the end of 2017. The short term payment ability in each year gradually increases by COH except 2019.

2.2 Debt Ratio Comparison

The debt ratio of both companies is given in the above graph. This graph indicates that COH mostly relying on the debts financing comparatively to RMD during this period. But on the other hand RMD had increased their debt financing as well. In 2019 RMD has taken more debts to finance their assets for generating revenue. At the end of 2017 COH has more than 50 % debt to finance their total assets.

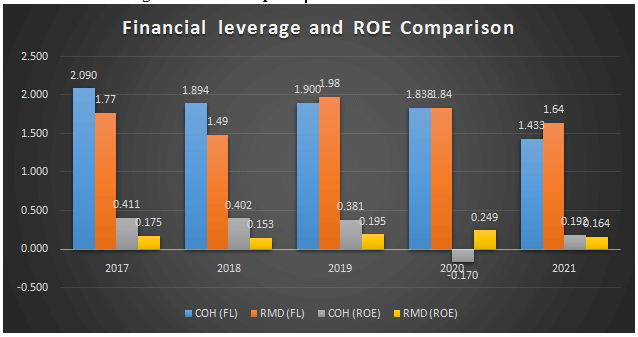

2.3 Financial Leverage and ROE Comparison

The financial leverage and ROE of both companies given in the above graph. The financial leverage of RMD during this period increases since 2019 comparatively to COH. On the other hand ROE equity of COH during this period was relatively higher. This shows that during this period shareholders of the COH increases shareholders wealth.

2.4NPM and ATO Comparison

NPM and ATO for the period 2017 to 2021 is given in the above chart. During this period, NPM of COH was higher except 2020 in which it was negative. On the other hand return on assets of RMD was higher during 2017 to 2019 but since then it get down which shows that efficiency and profitability of the RMD get down.

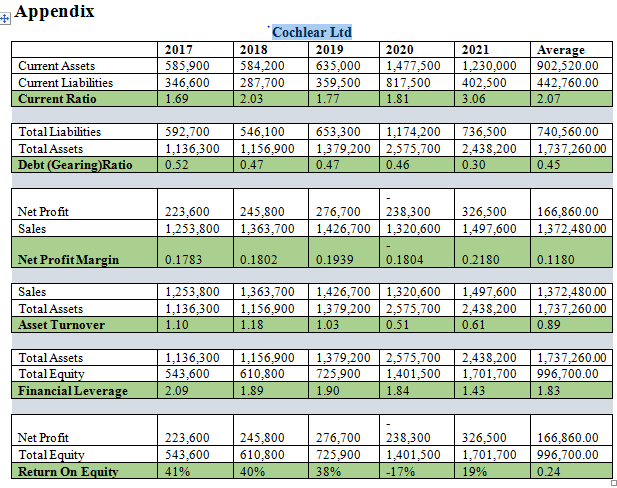

Table # 2 Average Comparatively Analysis

| Company | Current Ratio | Debt Ratio | NPM | ATO | FL | ROE |

| COH | 2.07 | 0.45 | 0.12 | 0.89 | 1.83 | 0.24 |

| RMD | 2.59 | 0.42 | 0.16 | 0.66 | 1.74 | 0.19 |

The comparative study of both COH and RMD for the five-year period beginning in 2017 and ending in 2021 is shown in the above table and graph. These numbers and graph display the averages of various ratios over the previous five years. The average net profit margin of the competitor during this time period is higher than COH, indicating that RMD has produced more profit for shareholders during this time. On the other hand, RMD’s return on equity is lower than COH’s, indicating that RMD has more shares outstanding, which reduces its return on equity and that RMD is also relying on debt financing rather than equity financing. The fact that the RMD’s average assets turnover is lower than the COH’s shows that the company’s management has utilized its resources for revenue creation effectively. Both companies relying on the debt financing as well. The debt ratio of COH is higher than the RMD.

3. DuPont Analysis

DuPont analysis is now commonly used to assess the operational effectiveness of two businesses that are identical. DuPont analysis is a framework for analyzing fundamental performance. DuPont analysis is a practical method for breaking down the various factors that affect return on equity (ROE). Leverage, operational effectiveness, and asset effectiveness, which measures operating efficiency, shows how much net income is produced for every dollar of sales. The Total Asset Turnover, which measures asset efficiency, shows how much revenue is produced for every dollar invested in assets. Finally, the Equity Multiplier determines financial leverage.

Table # 3 DuPont Analysis of COH

| DuPont Analysis | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Net Profit Margin | 18% | 18% | 19% | -18% | 22% | |

| Asset Turnover | 1.10 | 1.18 | 1.03 | 0.51 | 0.61 | |

| Financial leverage | 2.09 | 1.89 | 1.90 | 1.84 | 1.43 | |

| Return On Equity | 41.133% | 40.242% | 38.118% | -17.003% | 19.187% |

Table # 4 DuPont Analysis of RMD

| DuPont Analysis | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Net Profit Margin | 17% | 13% | 16% | 21% | 15% | |

| Asset Turnover | 0.60 | 0.76 | 0.63 | 0.64 | 0.68 | |

| Financial leverage | 1.77 | 1.49 | 1.98 | 1.84 | 1.64 | |

| Return On Equity | 17.461% | 15.327% | 19.525% | 24.897% | 16.443% |

The graph and tables above show the findings of DuPont’s analysis of both businesses. Both show that the COH’s net profit margin during this time was lower than RMD’s, but that the COH’s other asset turnover, financial leverage, and return on equity during this time were higher than those of its rival. This demonstrates that shareholders’ wealth during this period was significantly higher than RMD due to higher return on equity. The higher the return on equity, the greater the wealth of the shareholders.

Table # 5 Return on Equity from 2017 to 2021

| Company | 2017 | 2018 | 2019 | 2020 | 2021 |

| COH | 0.411 | 0.402 | 0.381 | – 0.170 | 0.192 |

| RMD | 0.175 | 0.153 | 0.195 | 0.249 | 0.164 |

In the above chart and table return on equity for the period of five years (2017-2021) is given of both companies. During this period at the end of 2020, the return on equity was negative which means company had not generated enough revenue which would have fulfill the expenses of the company. In spite of 2020, rest in all the years, COH had higher return on equity than the RMD.

4. Ethical considerations

Cochlear is dedicated to establishing and upholding a legal, moral, and responsible workplace that supports sound corporate governance. According to Cochlear’s Whistleblower Protection Policy, Eligible Protected Persons, which includes current and former suppliers as well as their employees, are able to report any any alleged wrongdoing by Cochlear, including any alleged cases of contemporary enslavement. The Company’s website offers access to the Whistleblower Protection Policy in English and other languages important to international business.In accordance with local laws and regulations, Cochlear employees and suppliers (including employees of suppliers) are able to submit anonymous reports of any violation of a law, regulation, Cochlear policy, or procedure, including any violations of Cochlear’s Global Code of Conduct and the Supplier Code of Conduct, through the company’s confidential whistleblower service, which is run by an outside organisation. Each report received through the Cochlear Whistleblower Service is forwarded to the Group General Counsel, who is then required to select an Investigating Officer to review the report and, if necessary, conduct an investigation.

In the event that Cochlear discovers any unfavourable supplier practises, it will engage with that supplier to offer support and implement the necessary changes to ensure that the supplier’s operations are in line with Cochlear’s standards and expectations. In order to promote improvements in safety, sustainability, labour standards, and ethical trade principles, suppliers are obliged to have a strong corrective action mechanism. If a supplier consistently violates the Supplier Code of Conduct, Cochlear will review the supplier’s commercial relationship with the company. If a supplier repeatedly violates the Supplier Code of Conduct, Cochlear may take further action, including but not limited to ending the supplier’s supply relationship.

5. Comparison of capital raising options

There are two options for both companies to raise the funds that is by issuing fresh share to general public or by issuing bonds, or getting loan from the commercial banks. Both options have their own positive and negative aspects. If company want to get funds through issuing shares than it will impact on the overall wealth of shareholders as more shares will minimize the per share price or wealth of the shareholders. On the other hand if company will get the funds through issuing bonds or any debt instruments than it can add more risk in the capital structure of the company(Yendaw,2022).

Both companies has the capacity to get the funds by issuing more debts in the market or can get loan from the financial intuitions. By getting debts from the financial institutions, or through issuing bonds, both companies can enjoy the benefits of getting debts. As both companies are more than 50% relying equity financing which means both firms have potential for debt financing. Debt financingincreases the wealth of the shareholders in the long run, though in short run it will put extra burden on the cash flow of the companies but in the long run it will add value in the shareholders wealth.

6. Recommendations and limitations

COH and RMD comparison for the five-year period starting in 2017 and concluding in 2021. The comparable company RMD’s average net profit margin over this time period was higher than COH’s, showing that RMD generated more profit for shareholders. However, RMD’s return on equity is lower than COH’s, indicating that RMD is using debt financing rather than equity financing and that it has more shares outstanding than COH. The fact that the average assets turnover for the RMD is lower than that of the COH demonstrates that the management of the business has effectively used its resources to generate revenue. Both businesses rely heavily on debt funding.Both businesses have the ability to raise money by issuing additional debt to the market or by obtaining a loan from financial institutions. Both businesses can profit from acquiring debts by borrowing money from financial institutions or by issuing bonds. Both businesses have the potential for debt financing because they depend on equity funding more than 50% of the time. In the long term, debt financing boosts the wealth of the shareholders. In the short run, it increases the burden on the companies’ cash flow, but in the long run, it boosts the wealth of the shareholders. On the basis of the last five years performance company has the capacity to pay off the debts, as its capital structure also suggested that company has strength to pay off the any sort of obligations. So being analyst, I will strongly recommend the loan should be approved which will add value to the COH as well profitable for the banks as well. There are certain limitation on the method used for analyzing the performance of the company. Only the financial outcomes are relevant to the ratio analysis. Recession, human elements, economic considerations (interest rate risk, inflation rate), skilled labour, political risk, etc. are some other issues that might hurt a corporate organization but are not taken into account by ratio analysis.

References

- Yendaw, E. (2022). Driving factors and sources of capital for immigrant entrepreneurs in Ghana. Journal of Global Entrepreneurship Research, 1-17.

- Drake, P. P., & Fabozzi, F. J. (2012). Financial ratio analysis. Encyclopedia of Financial Models.

- Kumbirai, M., & Webb, R. (2010). A financial ratio analysis of commercial bank performance in South Africa. African Review of Economics and Finance, 2(1), 30-53.

- Babalola, Y. A., & Abiola, F. R. (2013). Financial ratio analysis of firms: A tool for decision making. International journal of management sciences, 1(4), 132-137.

- Faruk, H., & Habib, A. (2010). Performance evaluation and ratio analysis of Pharmaceutical Company in Bangladesh.

- Uechi, L., Akutsu, T., Stanley, H. E., Marcus, A. J., & Kenett, D. Y. (2015). Sector dominance ratio analysis of financial markets. Physica A: Statistical Mechanics and its Applications, 421, 488-509.

Please place the order on the website to get your own firstly done finance homework help result.

Related Samples