There are several reasons that contributed to the failure of the First National Bank of Crestview. If we look at the provided bank statements, we can see that the bank had shrunk dramatically from assets of well over $250 million to just $74 million at the end of the quarter 4, 2014. Over the past decade, the bank has struggled with the shrinking of its retail deposits. It is impossible for any bank to grow its loan portfolio without having a stable deposit base and thus First National Bank of Crestview nosedived and failed to grow.

On the other hand, the bank failed to control its operating expenses which continued to rise rapidly. It had an efficiency ratio of around 45% (Operating expenses/revenue) in 2005 which was very reasonable considering the size of the bank. However, this ratio kept on getting worse so much so that it was around 100% in 2010 and reached around 700% in its last quarter filling, at the end of December 2014.

Tier 1 capital was also declined rapidly and it was very low at just around 2.4% at the end of 4th quarter 2014.

If we look at the net interest in earning assets, it declined steadily in the last four quarters. As we have annualized the figures in the above calculations, it was just 2% in the last quarter, which was very low.

The net income to total equity is also declined rapidly in the last year. According to annualized figures, it was 23.11% in the first quarter of 2014, the last quarter where it reported a positive return. After that, it declined rapidly and get to -638.84% in the last quarter.

On the other hand, if we look at the Net income to total assets, again the bank’s performance kept on deteriorating and a bank which had reported a profit in the first quarter of 2014, reported a loss of 2.99% in the fourth quarter. So the bank’s earning really dipped down rapidly in the last year, which was perhaps the biggest reason for its downfall.

Capital Analysis

If we look at the capital of the Bank, it also deteriorated very rapidly, particularly in the last year. While the annualized figure for Tier1 capital to Total assets was 13.09% in the first quarter, it declined to less than 1% in the last quarter. Tier 1 capital to Risk-weighted Assets and both Tier 1 and Tier 2 capital to risk-weighted assets also follow a similar path. So the bank was failed badly to maintain its capital as well, which was mainly because the company has failed to earn sufficient income.

The bank’s growth gets negatively rapidly, particularly in the last year as evident from the ratios below.

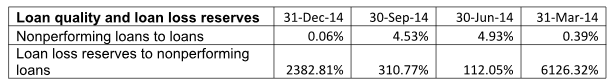

However, one area where the bank did well was its loan quality and loan loss reserve as evident from the ratios below.

The asset concentration of the bank in CRE and CLD loans went down steadily throughout the last year.

Overall, many factors contributed to the failure of the bank. The major reason of the failure of the bank was lack of efficiency in the governance of the bank by the management and the board, Moreover, the risk management by the bank was also highly deficient. Then, over aggressive growth strategy particularly in the incommercial real estate lending that was mainly focused in construction and development loans as evident from the loan data and then highly deficient credit administration and lower asset quality.

Please place the order on the website to get your own firstly done finance homework help result.

Related Samples