Introduction:

The ford Motor is the American multination company in the filed of the vehicle manufacturing. It was established in June, 16, 1903 by the Henry Ford. The Ford Motors is the world renounced care manufacturing brand. At the end of 2021, its total revenue was around 136 million dollars. There are approximately 200,000 employees working world wide under the name of the company. Ford Motors has number of subsidiaries and the stock of the company is traded at the New York stock exchange which is one of the biggest stock exchange in the world.

What does company do?

It is an American automobile company and it deals with manufacturing and sales of automobiles. It was founded by Henry Ford and it deals with automobiles. Ford Company sell their vehicles under the name of Ford and also sell luxury cars. Ford has their own manufacturing operations. It designs and manufactures truck and other vehicles.

Targeted market of the business:

The market of ford is spread all over the world. They mostly sale their vehicles to USA and other European countries. They also expect to grow their business in China and India. It has put the world on vehicles and it has been manufacturing all kinds of automobiles according to the needs of the customers. Ford offer good quality cars. The cars have strong safety system and many airbags.

Reason for choosing this company:

The reason for choosing this company that it is listed on New York exchange and has various number of investment option. It has seen in past that it has many positive cash flows and most important it has maintained profitability and sustainability in the market. It has low value of shares which means many of the people can invest in it. They have positive catalyst and it can be used as good long-term investment because of its profitability and sustainability. It also has positive catalyst and can be a good form of investment. They also provide good returns on their shares and keep the price low for new investors.

Weakness of the company:

- One of the major weaknesses is limited global scope of production of ford. It is facing shortage of computer chips and they are making half of the vehicles as compared to the expected products.

- Competitors can also be a threat as well as weakness for the business such as tesla. There is sometimes cut throat business in auto Motors Company. So, tesla and Audi can also be threat to the business.

Strength of the company:

Following are the strength of the company:

- They have highest brand value worth $10.44 billion. They have strong brand worth as they have more reserves of the company.

- They are also performing research and development task and it can also be considered as strength of the company.

- They have earned loyalty of the customers and they have very loyal customers which is considered as strength against competitors.

Stock price Movement

The stock price of the company since January 2020 to 31st December 2021 is presented in the following graph.

The graph of the stock price of the company suggest in the beginning of the 2020 year the price of the company stock get down but since march 2020 the stock price is going upward or gaining in every next month. The stock of the company comparatively to January 2020 was much higher at the end of December 2021.

Project Analysis of the Ford Motor

The Ford Motors is established a new plant in the Michigan for fulfilling the demand of the Asian countries. This plant has the following outcomes based on the different assumptions.The life of the plant will be for 10 years based on the straight line depreciation method. There is no scrap value of the plant.

This project is based on the ten year time line which will increase the overall sales of the company especially in the Asian continent. The cost of this plant is $1,000,000,000 (1 billion dollars). The depreciation of this plant is fixed and straight line method is applied. The tax rate on the income of this plant in the initial years is 16% but at the end of last two years, its increases to 17% due to expected economic conditions in the region. For the operation of the plan the net working capital also varies during the life of the asset.

Cash flow analysis of the project

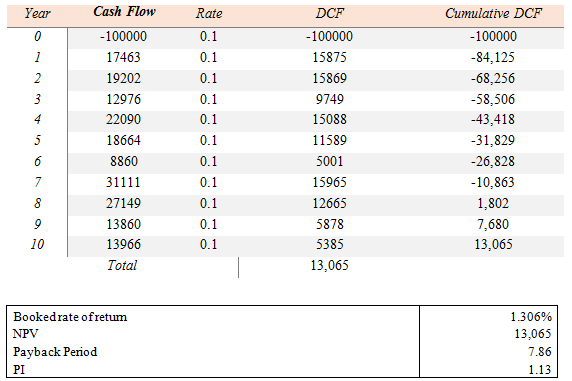

Discounted rate assumed = 10%

Discounted Cash flows = CF/ (1+r) ^n

Cumulative Cash Flows = CF current year + CF last year

NPV = Sum of all the DCF

Discounted Payback Period = Year before recovery + remaining DCF / Next year DCF

Profitability Index = 1+ net income / cost of investment

Book rate of return = average profit / cost of investment

The above table shows the findings of the project based on the capital budgeting techniques. The analysis of this project suggest that this project will be profitable for the company in the next ten years. The rate of return though is lower comparatively to higher investment but yet it’s positive. Similarly NPV of the project is also positive, the principle rule of the accepting and rejecting of NPV is that it has positive returns at the end of the period. Though the payback period of this project is higher which is seven years, eight months and six days. The profitability index of the project is greater than one which means it’s profitable. All the capital budgeting techniques suggesting that this project must be accepted which will increase the value of the shareholders.

Conclusion:

The main conclusion is that it is highly recommended to make investment in this project because after analyzing the outcomes of the project and performance ofthis project it shows that company can increase its overall favorable cash flows and it will be beneficial if is invested in this Ford Motor plant project. It is recommended to make investment in this project after analyzing all the factors and outcomes of the investment. In this case, it is seen it is good to make investment, as sales are going up and there is also increase in earnings. The cash flows of the company are positive and company is making progress and it is seen that in near future there will be increase and growth in the company so it is recommended to invest.

References

- (2017). “Why Amazon Is The World’s Most Innovative Company Of 2017” https://publicaffairs-sme.com/PatriotFamily/wp-content/uploads/2015/01/Why_Amazon_is_most_innovative_company_13_Feb_2017.pdf

- Edward and Lincoln. (2018). “Porter Analysis: A Business Strategy of Amazon.com Through a Value Chain and Comparative Advantage Analysis of Amazon’s Trademarks and Intangibles” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3234380

- (2008). “Jeff Bezos and Amazon.Com” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1280551

- Hong, Bhattacharyya and Geis. (2012). “The Role of M&A in Market Convergence: Amazon, Apple, Google and Microsoft” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2165444

- Kumar, Eidem and Perdomo. (2012). “Clash of the e‐commerce titans: A new paradigm for consumer purchase process improvement” https://www-emerald-com.adu-lib-database.idm.oclc.org/insight/content/doi/10.1108/17410401211263872/full/html

- (2002). “A business history to appear in e-commerce management: text and cases” https://paginas.fe.up.pt/ipc/suporte/varios/amazon_final.pdf

- Pandit and Poojari. (2014). “A Study on Amazon Prime Air for Feasibility and Profitability– A Graphical Data Analysis.” http://www.iosrjournals.org/iosr-jbm/papers/Vol16-issue11/Version-1/B0161110611.pdf

- (2013). “Inventory Turnover Ratio Analysis” https://strategiccfo.com/inventory-turnover-ratio-analysis/

- Al Nuaimi, Aysha and Nobanee, Haitham, Corporate Sustainability Reporting and Corporate Financial Growth (2019). Available at SSRN: https://ssrn.com/abstract=3472418 or http://dx.doi.org/10.2139/ssrn.3472418

- Al Ahbabi, Al Reem and Nobanee, Haitham, Conceptual Building of Sustainable Financial Management & Sustainable Financial Growth (October 19, 2019). Available at SSRN: https://ssrn.com/abstract=3472313 or http://dx.doi.org/10.2139/ssrn.3472313

- Almarar, Fatima and Nobanee, Haitham, Sustainability and Risk: A Mini-Review (2020). Available at SSRN: https://ssrn.com/abstract=3539058 or http://dx.doi.org/10.2139/ssrn.3539058

Please place the order on the website to get your own firstly done finance homework help result.

Related Samples

Comparative Performance Analysis OF Dollar Tree And Dollar General